Property investment and the hidden cost of “growth” in a secondary city

“Thessaloniki is turning into Athens” as “Real estate developers and REITs are casting nets in housing” are some of the headlines used recently by market actors to celebrate the surge in property investment in the second largest city of Greece, Thessaloniki. It is a trend that started prior to the Covid-19 pandemic and has been accelerating much more recently. According to these actors and press releases, the local real estate market, especially in the city’s central areas, is expected to post a steady annual growth of 7-8% in the following 10 years, reflecting, as well as driving, the city’s growth prospects.

These trends are largely the culmination of a ten-year era of recession and austerity that led to a large decrease in sale and rental prices, as well as a decline in home ownership and owner occupation. In Thessaloniki, it also led to the intensification of business closures and/or their relocation to neighbouring Balkan markets where production costs were significantly lower, accelerating a process that started before the crisis and has been ongoing until today. This resulted in the abandonment and desertification of entire neighbourhoods, marked in the past by the large presence of small-scale industrial businesses. The old commercial centre of Thessaloniki was dominated by small textile industries, the majority of which moved or closed in the 2000s and 2010s. This process generated the proliferation of empty or unused property stock, both of residential and commercial use, and large declines of land and asset values in the aforementioned areas.

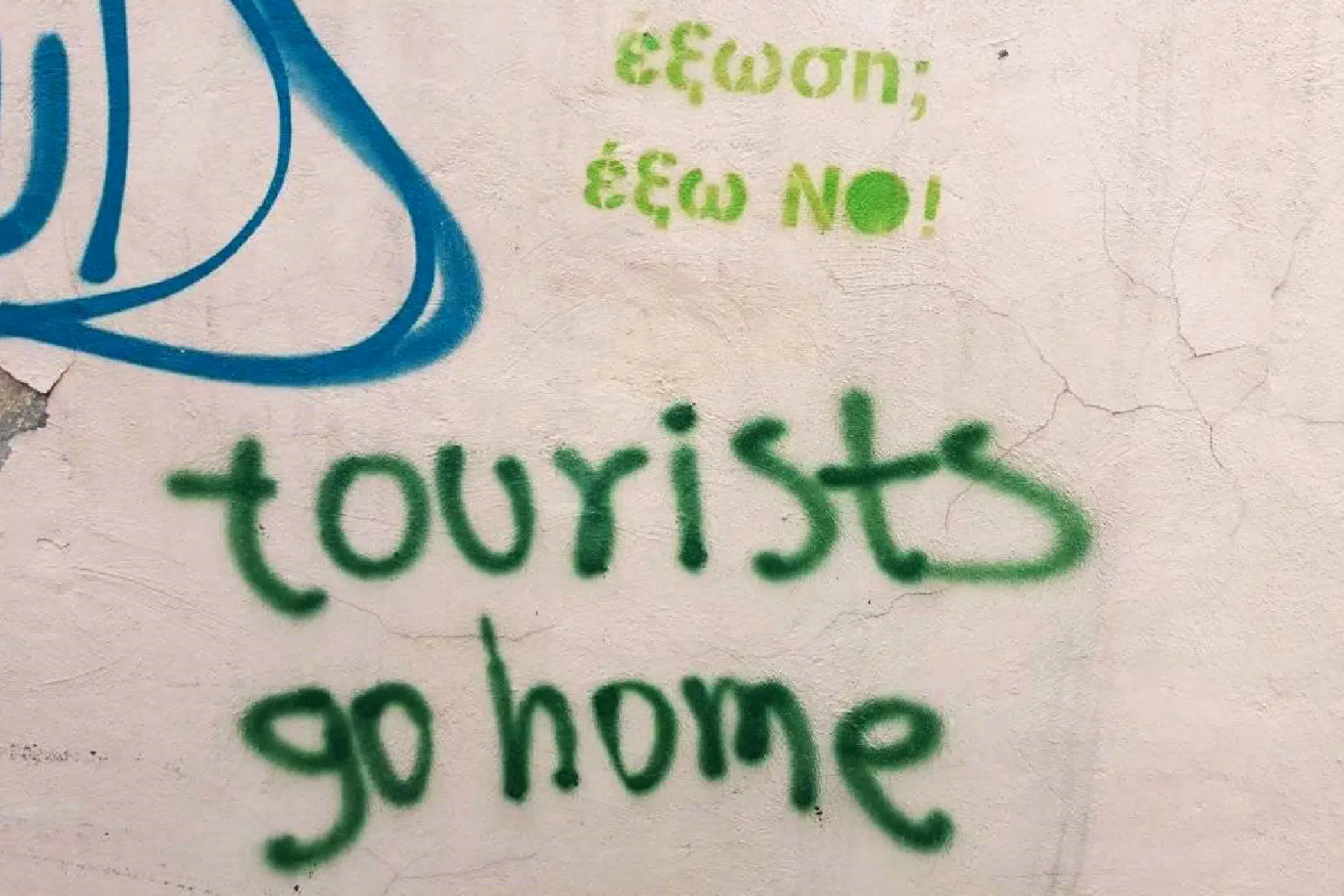

These developments laid the conditions for the facilitation of a transition to a post-industrial and post-homeownership context, with opportunities to capitalise on significant rent gaps, mainly driven by tourist flows and the rising presence of other types of temporary visitors. As noted in the literature, the growth model that emerged in post-industrial cities was based on the economy of consumption, as an alternative to the decline of values in the areas abandoned by the industry and/or by its residents. Especially in Southern European cities, tourism has played a crucial and integral part in this transition, often leading to a surge in touristification. These developments have been clear and well-documented in the literature in the case of major cities in Southern Europe. However, these trends have been less than clear or documented in smaller, secondary cities, such as in the case of Thessaloniki. In this second-largest city of Greece tourist flows, for example, have remained low until recently. However, it is increasingly becoming obvious that a similar process of restructuring is also currently underway in Thessaloniki, with tourism and short to medium-term rentals as underlying drivers.

There are several indicators for this:

a) A surge in property investment by various types of investors and developers, mainly of Israeli, Balkan and Greek origin. These actors have been buying and redeveloping individual apartments and (parts of) entire buildings, turning them into luxurious apartments and hotels for the purposes of serving tourists, visitors and other temporary residents such as students, expats and professionals. This has led to what is known by market actors as parcellation - a term used to describe the practice of acquiring large and abandoned industrial spaces followed by their renovation and segmentation into smaller residential units for resale or rental in the short and medium-term rental market.

b) The institutional framework that has been facilitating this transition and restructuring at both the national and local levels. In the last 5 years, a series of laws have made possible the increasing alignment of real estate and financial markets. Indicatively, these laws refer to the establishment of the secondary NPL market, the introduction of mortgage loan securitization supported by state guarantees, the abolition of the debtor’s home protection and concurrent liberalisation of foreclosures, as well as one of the most generous golden visa schemes, offering investors Greek -and European- citizen status for property investments of a mere 250.000 euros. (Recently this amount increased to 500.000 for certain areas including the Municipality of Thessaloniki, boosting investment by 130% in national total, prior to the change).

c) Large infrastructure projects that are currently underway or planned to happen with the intention to attract visitors and tourists. These include the megaprojects of the city’s metro system and the redevelopment of the port including an expansion for cruise ships and visitors, as well as smaller projects intended to attract visitors from Israel, the wider Balkan area and Europe. For example the construction of the Holocaust museum will pay homage to the once large and vibrant Jewish community of Thessaloniki and is already attracting the interest of visitors and investors of Israeli origins.

This is marking a new era for the city’s property regime, where central neighbourhoods are changing ownership and uses, increasingly acquired by financialised market actors, a trend which is expected to drive the financialisation of housing in the secondary city of Thessaloniki as opposed to larger scale financialisation dynamics in Athens and widely in Greece, driven significantly by high-yielding opportunities in the distressed NPL and REO markets. Importantly, it is motivated by open rent gaps currently presented in central areas of the city, such as the historical commercial centre and the city’s western entrance, adjacently located to the port. In these areas, values were significantly low until recently and thus the reinvestment of capital can lead to high surplus values, as a result of a current rising trend in both sale prices and rental yields. This is already generating a process of gentrification, driven by an increase in tourist flows and investments in rising market segments such as medium-term rentals and higher-end student accommodation.

The cost of “growth” in property investment and the real estate market is that central areas of the city are becoming increasingly inaccessible to long-term residents and citizens, especially given the large discrepancy between rent prices and wages, catapulting housing cost overburden for the city’s tenants. Rents have been growing significantly since 2020, with an exponential growth happening in 2021-2023. In the city’s historical centre they have now reached up to 10-12 euros / sq.m. and in some cases up to 25 euros / sq.m. marking an increase of more than 40% since 2018. This is practically making the city centre and increasingly the areas adjacent to the centre non-affordable zones for the majority of the city’s residents. Unless restrained by necessary policies, these processes are thus expected to induce a wider process of restructuring and change in the city’s socio-economic geography.

REFERENCES

Cocola-Gant, A. (2018). Tourism gentrification. In Lees, L. & Phillips, M. (Eds.), Handbook of Gentrification Studies, 281-293. Cheltenham: Edward Elgar.

Judd, D.R. and Fainstein, S.S. (1999). The Tourist City. New Haven and London: Yale University Press.

Katsinas, P. (2021). Professionalisation of short-term rentals and emergent tourism gentrification in post-crisis Thessaloniki. Environment and Planning A: Economy and Space, 53(7), 1652-1670.

REMAX (2023, 2021, 2018). Residential Rentals Report RE/MAX HELLAS [In Greek]. https://www.remax.gr/news/list?category=researches

REMAX (2023). Real Estate Sales Report 2022 RE/MAX HELLAS [In Greek]. https://www.remax.gr/media/news/636-gr.pdf

Sakali, C. and Karyotis, T. (2022). Can’t #StayAtHome without a home: Politics of housing precarity in Greece in the time of pandemic. In C. Petropoulou et al. (eds) Luchas Invisibles En Tiempos de Pandemia Vol.II, 339-366. Mytilene and Puebla: University of The Aegean / BUAP. https://aoratespoleis.files.wordpress.com/2022/04/luchas-invisibles-en-tiempos-de-pandemia-ii-2.pdf